Singapore Bolsters Efforts to Combat Money-Laundering

August 5, 2024

On 2 July 2024 Parliament introduced the Anti-Money Laundering and Other Matters Bill for the First Reading in Parliament and passed the Corporate Service Providers Bill and the Companies and Limited Liability Partnerships (Miscellaneous Amendments) Bill

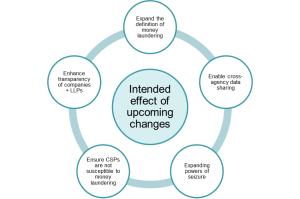

The new bills follow the bust of a sprawling money laundering ring and the seizure of $2.24 billion in assets last August. The intention of the bill is to ensure that Singapore’s laws remain effective an evolving crime landscape. The expanded powers of law enforcement and the bills are part of a new National Asset Recovery Strategy first announced by PM Lawrence Wong and indicates a shift in focus with the stricter regulations.

Read on for an overview of the impending changes and practical steps that businesses should take in light of these changes.

Expanding the definition of money laundering

The amendments to the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act (CDSA) expands the definition of money laundering. Currently, under the CDSA criminal liability for money laundering attaches where the monies allegedly laundered in Singapore are proceeds which can be directly linked to specific serious predicate offences. The amendments are intended to:

- Remove the requirement to establish a direct link between the monies allegedly laundered to specific criminal conduct. Instead, it need only be shown that money launderer knew or had reasonable grounds to believe that he was dealing with criminal proceeds.

- Expand the definition of serious offences to include serious predicate foreign environmental crimes, such as illegal mining and illegal logging.

These tabled amendments are intended to facilitate the prosecution of money mules where tracing the criminal proceeds poses difficult as it has passed through numerous banks or intermediaries in foreign jurisdictions before entering Singapore. They also recognise that laundering criminal proceeds from crimes that may be prevalent in the region and cause serious environmental damage should be made an offence. Finally, it opens up new assets which may be recovered as part of Singapore’s new National Asset Recovery Strategy.

Enabling cross-agency data sharing

The amendments to the Income Tax Act, Goods and Services Tax Act, Regulation of Imports and Exports Act, Free Trade Zones Act are intended to ensure that law enforcement has access to more complete intelligence:

- The Inland Revenue Authority of Singapore (IRAS) and Singapore Customs will be able to share tax and trade data with Singapore’s Financial Intelligence Unit, the Suspicious Transaction Reporting Office (STRO) of the Commercial Affairs Department of the Singapore Police Force.

- The Council for Estate Agencies and the Accounting and Corporate Regulatory Authority (ACRA) will have access to suspicious transaction reports filed by their respective regulated entities.

The data-sharing between agencies no doubt is targeted at better identifying illicit fund flows and potentially assets for recovery.

Expanding powers post-seizure

The amendments to the Criminal Procedure Code are intended to allow the Court to more efficiently and effectively manage seized properties linked to suspected criminal activities. They can order the sale of seized properties, where they are no longer required for investigations or court proceedings and one of the following is satisfied:

- all parties consent to the sale;

- the value of the property is likely to depreciate, or undue costs are involved in maintaining the property; or

- the sale would be in the interests of justice.

Law enforcement will no longer be constrained by having to obtain consent from all parties before applying for an order from the Court to sell the seized properties. This allows law enforcement to dispose of property instead of having to expend costs to maintain the seized property in good condition.

Ensuring Corporate Service Providers (CSPs) are not susceptible to money laundering

CSPs provide a range of services to businesses, such as forming a corporation on behalf of another, providing a registered office for the corporation or acting as a nominee shareholder on behalf of certain types of corporations. Non-residents looking to set up companies in Singapore must engage a CSP to do so and without adequate regulation CSPs may become vehicles for money laundering. The CSP Bill is intended to deter just this:

- All CSPs will be required to register with ACRA, not just CSPs that carry out transactions with ACRA on behalf of their customers. This means that all CSPs will be regulated by ACRA and will accordingly have obligations to ensure their CSPs are not vehicles for financial crimes.

- An individual will only be able to act as a nominee director by way of business if the nominee directorship is arranged by a CSP, or if the individual is the sole proprietor of a registered CSP. Also, CSPs will be required to ensure that nominee directors are fit and proper.

- Sanctions for CSPs failing to comply with obligations to detect and prevent money laundering will be increased from a maximum fine of $25,000 to a maximum fine of $100,000. Under the revised law, senior management can also be fined if they knew or ought reasonably to have known that the offence would be or is being committed, but failed to take all reasonable steps to prevent or stop the commission of that offence.

Enhance transparency of companies and limited liability partnerships (LLPs)

By mandating complete and accurate information in the company’s or LLP’s register, there will be transparency as to who the beneficial owners and nominee directors are. This will allow law enforcement to detect money laundering more easily and for banks, CSPs and other gatekeepers, to be able to conduct due diligence checks more effectively. The bill provides that:

- The maximum penalty for failing to keep the register up-to-date or accurate will be increased from $5,000 to $25,000.

- It will also be an offence to provide false or misleading information about the register to ACRA, with a maximum fine of $25,000. Liability attaches where reasonable due diligence was not exercised.

- Companies and LLPs will be required to verify and update their controller’s information on an annual basis.

- Companies will be required to provide the full information of nominee arrangements to ACRA, which will be made available to law enforcement. This will include particulars of the nominees and identities of nominators.

Why does this matter?

The obvious and intended effect of these bills is to more precisely detect and deter money laundering. Expanded powers of law enforcement and the Courts are no doubt geared towards a pivot to focus on the recovery of those assets and their transmission to rightful claimants.

Practically speaking, businesses should remember that:

- CSPs must register with ACRA.

- CSPs should implement protocol to detect and report money laundering, taking into account the expanded definition of money laundering.

- CSPs should ensure that prospective nominee directors possess the requisite competency, capacity and integrity. This includes reviewing the prospective nominee director’s compliance records to see if they have the capacity to take on more directorships.

- Companies and LLPs must keep their register updated, and implement protocol to ensure that no false or misleading information about the register is provided to ACRA. If you are a CSP, you should remind your customers to ensure that the information in their registers is up to date.

- Companies and LLPs must update their controller’s information annually.

- Companies must provide ACRA with complete information about its nominee arrangement.

Prolegis LLC has significant experience advising both local and foreign clients on how best to structure their business, business conduct rules, and anti-money laundering compliance.

If you want to find out more about protecting your interests in such proceedings in Singapore, please contact the lawyers below or your usual Herbert Smith Freehills Prolegis contact.

Prolegis LLC and Herbert Smith Freehills LLP http://www.herbertsmithfreehills.com) are members of a Formal Law Alliance in Singapore marketed as Herbert Smith Freehills Prolegis (https://www.herbertsmithfreehills.com/legal-and-regulatory/herbert-smith-freehills-prolegis).

Daniel Chia |

Samyata Ravindran |

||||